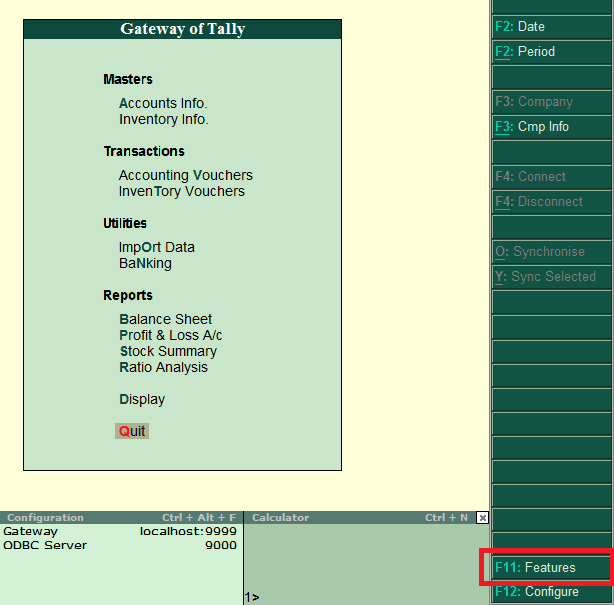

Step 5: Make entry is Sales voucher from Gateway of Tally > Accounting Vouchers > Press F8. Step 4: Create the following stock items in active company:įill 12% rate in Integrated Tax which is automatically divided equally between Central and State tax 6%.įill 18% rate in Integrated Tax which is automatically divided equally between Central and State tax 9%.

Step 1: Active an existing company or create a new company in which you want to apply multi tax rate under GST in Tally ERP9. If you want to apply multiple tax rate under GST in Tally ERP 9 then you have to take follow given steps. Steps How to use Multi Tax Rate under GST in Tally ERP9 Now you want to apply both stock item tax rate in single invoice under the GST in Tally ERP 9.

So, we have to discuss step by step way from which you can easily apply multi tax rate under GST in Tally ERP9.įor eg: If you have two different stock item like Kurty and Nivea cream and both stock item have different tax rate 12% and 18% (CGST+SGST). You can easily make single tax rate entry under GST in Tally ERP9 but if you need to apply multi tax rate then you have to face problem.

If you want to prepare sales tax invoice then you have to use Output Tax (CGST & SGST). During making entry in purchases voucher you have to use Input Tax (CGST & SGST). Must Read: Purchases and Sales Entry with GST in Tally ERP 9Īll we know there are two category under the GST – Input tax and Output Tax. In this article we have to describe how could you easily create a single sales invoice with multiple GST rates. It’s not easy to do this job, most of the Tally users face lot of problem when they want to apply multiple tax rate in single invoice under GST in Tally ERP9. Sometime we need to show multi tax rate under GST in Tally ERP9 during preparing the tax invoices.

All we know GST applicable in whole country now you have to prepare different tax invoice under the GST.

0 kommentar(er)

0 kommentar(er)